The concept of dynamic leverage is used for Bybit's Risk Limit. This means the larger the contract value traders hold, the lower the maximum leverage allowed. In other words, the initial margin (IM) requirement goes up incrementally by a fixed percentage at every specific increase in contract value level. Please note that under cross margin, the maintenance margin (MM) base rate is 0.5% for BTC, and the margin requirements will increase or decrease accordingly as the risk limit changes.

Risk limit is a risk management measure that limits the risk exposure of traders. A large position with high leverage may cause huge contract losses when liquidated in a highly volatile market. Contract losses are created when the account MM rate hits 100%. To manage position risk, Bybit imposes a risk limit on all trading accounts according to the position contract value held under cross margin.

The MM and IM requirements will also increase as the position contract value increases. A USDC margin account supports two margin modes — cross margin and portfolio margin.

Cross Margin

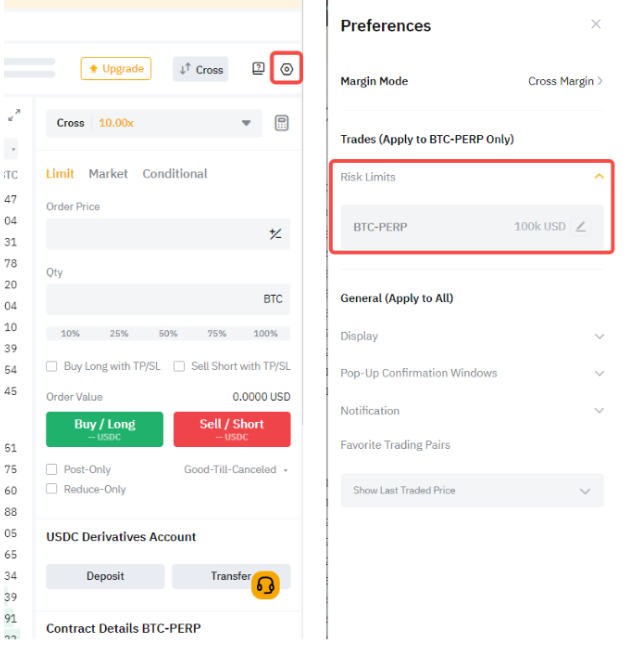

— Users can choose to increase or decrease the risk limit through the Asset Overview Trading Preference panel. The default risk limit on Bybit will always start from the lowest risk limit level.

— Bybit will perform a laddered liquidation process for traders using higher risk limits, and will automatically reduce the level of maintenance margin by attempting to reduce the risk limit levels to the lowest possible, in order to avoid an immediate full liquidation of the trader’s position. For more information, please refer to Liquidation Process (USDC Perpetual Contract) and Trading Rules: Liquidation Process (UTA).

Portfolio Margin

— Users are not allowed to adjust the risk limit, which is based on the overall portfolio of the USDC account.

— If there are only perpetual contracts in the account, it will follow the liquidation process under the cross margin. If there are options, once the liquidation is triggered, all positions will be liquidated.

For more details on the liquidation process, please click here.

The following risk limit information only applies to cross margin.

Formula

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk Limit Table

USDC Perpetual

BTC

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

100,000 |

0.40% |

0.80% |

125.00 |

|

2 |

1,000,000 |

0.50% |

1.00% |

100.00 |

|

3 |

2,000,000 |

1.00% |

1.50% |

66.67 |

|

4 |

3,000,000 |

1.50% |

2.00% |

50.00 |

|

5 |

4,000,000 |

2.00% |

2.50% |

40.00 |

|

6 |

5,000,000 |

2.50% |

3.00% |

33.33 |

|

7 |

6,000,000 |

3.00% |

3.50% |

28.57 |

|

8 |

7,000,000 |

3.50% |

4.00% |

25.00 |

|

9 |

8,000,000 |

4.00% |

4.50% |

22.22 |

|

10 |

9,000,000 |

4.50% |

5.00% |

20.00 |

|

11 |

10,000,000 |

5.00% |

5.50% |

18.18 |

ETH

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

500,000 |

1.00% |

1.50% |

66.67 |

|

2 |

800,000 |

1.50% |

2.00% |

50.00 |

|

3 |

1,000,000 |

2.00% |

2.75% |

36.36 |

|

4 |

1,800,000 |

2.50% |

3.50% |

28.57 |

|

5 |

2,600,000 |

3.00% |

4.25% |

23.53 |

|

6 |

3,400,000 |

3.50% |

5.00% |

20.00 |

|

7 |

4,200,000 |

4.00% |

5.75% |

17.39 |

|

8 |

5,000,000 |

4.50% |

6.50% |

15.38 |

|

9 |

5,800,000 |

5.00% |

7.25% |

13.79 |

|

10 |

6,600,000 |

5.50% |

8.00% |

12.50 |

SOL/ADA/GMT/XRP/AVAX/ETC/MATIC/OP/SAND/APE/NEAR/BNB

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

150,000 |

1.00% |

2.00% |

50.00 |

|

2 |

300,000 |

1.50% |

3.00% |

33.33 |

|

3 |

450,000 |

2.00% |

4.00% |

25.00 |

|

4 |

600,000 |

2.50% |

5.00% |

20.00 |

|

5 |

750,000 |

3.00% |

6.00% |

16.67 |

|

6 |

900,000 |

3.50% |

7.00% |

14.29 |

|

7 |

1,050,000 |

4.00% |

8.00% |

12.50 |

|

8 |

1,200,000 |

4.50% |

9.00% |

11.11 |

|

9 |

1,350,000 |

5.00% |

10.00% |

10.00 |

|

10 |

1,500,000 |

5.50% |

11.00% |

9.09 |

ATOM/EOS/CHZ/LDO

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

70,000 |

2.00% |

4.00% |

25.00 |

|

2 |

140,000 |

2.50% |

5.00% |

20.00 |

|

3 |

210,000 |

3.00% |

6.00% |

16.67 |

|

4 |

280,000 |

3.50% |

7.00% |

14.29 |

|

5 |

350,000 |

4.00% |

8.00% |

12.50 |

|

6 |

420,000 |

4.50% |

9.00% |

11.11 |

|

7 |

490,000 |

5.00% |

10.00% |

10.00 |

|

8 |

560,000 |

5.50% |

11.00% |

9.09 |

|

9 |

630,000 |

6.00% |

12.00% |

8.33 |

|

10 |

700,000 |

6.50% |

13.00% |

7.69 |

USDC Futures

BTC

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

375,000 |

1.50% |

2% |

50 |

|

2 |

500,000 |

2% |

2.50% |

40 |

|

3 |

625,000 |

2.50% |

3% |

33.33 |

|

4 |

750,000 |

3% |

3.50% |

28.57 |

|

5 |

875,000 |

3.50% |

4% |

25 |

|

6 |

1,000,000 |

4% |

4.50% |

22.22 |

|

7 |

1,125,000 |

4.50% |

5% |

20 |

|

8 |

1,250,000 |

5.00% |

5.50% |

18.18 |

|

9 |

1,375,000 |

5.50% |

6% |

16.66 |

|

10 |

1,500,000 |

6.00% |

6.50% |

15.38 |

|

11 |

1,625,000 |

6.50% |

7% |

14.28 |

|

12 |

1,750,000 |

7.00% |

7.50% |

13.33 |

|

13 |

1,875,000 |

7.50% |

8% |

12.5 |

|

14 |

2,000,000 |

8.00% |

8.50% |

11.76 |

|

15 |

2,125,000 |

8.50% |

9% |

11.11 |

|

16 |

2,250,000 |

9.00% |

9.50% |

10.52 |

|

17 |

2,375,000 |

9.50% |

10% |

10 |

|

18 |

2,500,000 |

10.00% |

10.50% |

9.52 |

|

19 |

2,625,000 |

10.50% |

11% |

9.09 |

|

20 |

2,750,000 |

11.00% |

11.50% |

8.69 |

ETH

|

Tier |

Position Value (USDC) |

MM% |

IM% |

Max leverage |

|

1 |

100,000 |

1.50% |

2% |

50 |

|

2 |

125,000 |

2% |

2.75% |

36.36 |

|

3 |

225,000 |

2.50% |

4% |

28.57 |

|

4 |

325,000 |

3% |

4.25% |

23.52 |

|

5 |

425,000 |

3.50% |

5% |

20 |

|

6 |

525,000 |

4% |

5.75% |

17.39 |

|

7 |

625,000 |

4.50% |

7% |

15.38 |

|

8 |

725,000 |

5.00% |

7.25% |

13.79 |

|

9 |

825,000 |

5.50% |

8% |

12.5 |

|

10 |

925,000 |

6.00% |

8.75% |

11.42 |

|

11 |

1,025,000 |

6.50% |

10% |

10.52 |

|

12 |

1,125,000 |

7.00% |

10.25% |

9.75 |

|

13 |

1,225,000 |

7.50% |

11% |

9.09 |

|

14 |

1,325,000 |

8.00% |

11.75% |

8.51 |

|

15 |

1,425,000 |

8.50% |

13% |

8 |

|

16 |

1,525,000 |

9.00% |

13.25% |

7.54 |

|

17 |

1,625,000 |

9.50% |

14% |

7.14 |

|

18 |

1,725,000 |

10.00% |

14.75% |

6.77 |

|

19 |

1,825,000 |

10.50% |

16% |

6.45 |

|

20 |

1,925,000 |

11.00% |

16.25% |

6.15 |

Risk Limit Table

- USDC Perpetual

- USDC Futures

BTC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ETH

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOL/ADA/GMT/XRP/AVAX/ETC/MATIC/OP/SAND/APE/NEAR/BNB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|